tax strategies for high-income earners 2020

If your work or assets generate significant income you could pay up to half of your earnings to the US. Here are some methods for controlling your gains.

Tax Strategies For High Income Earners Wiser Wealth Management

Review Your Withholdings to Avoid Underpayment Penalty.

. Learn More At AARP. Create a charitable remainder trust and contribute valued securities to it. If you have a high-deductible insurance plan you can put some of your money in Health Savings Accounts for retirement and medical purposes.

However there are even more ways that charitable giving can provide tax relief. If you wish to save tax money it is better to contribute to a savings account or health plan. One of my favorite tax strategies for high income earners is investing in real estate.

A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. But its one of the simplest tax strategies to employ if youre not currently maxing out on it. New Look At Your Financial Strategy.

RMDs from age 70-12 to age 72 in 2020. Additionally you are not required to pay taxes on investment earnings from retirement accounts until you actually withdraw them. In 2020 you can deduct the mortgage interest paid on as much as 750000 of a homes principal.

In charitable remainder trusts income is. Ad Tax Strategies that move you closer to your financial goals and objectives. To obtain updates run reports via a financial planning portal.

If theres potential for a high return by investing a smaller amount of money upfront Roth can be the way to go. If youre a very high income earner this wont save you a ton on taxes. With a CRT high-income earners and small business owners can give to a worthy cause while creating an income stream for themselves or their loved ones.

These brackets change more or less every year but for the 2020-2021 tax year these are the values for federal income tax. We provide guidance at critical junctures in your personal and professional life. If youre looking for another way to avoid paying higher taxes now then it might make sense to defer taxes on realized gains.

At Buttonwood this process starts by duplicating 2020 tax return data and updating the data for 2021. We cant talk about tax strategies for high-income earners without mentioning real estate. The IRS allow owners of resident occupied real estate to depreciate property over 275 years.

Creating retirement accounts is one of the great tax reduction strategies for high income earners. We often encourage high-earners in particularly high-income years to contribute to a donor-advised fund. Trial Tax Return.

Deductions for contributions of non-cash assets are capped at 30. Its called HAS and many high-income people dont utilize the plan or use it incorrectly. In this blog we will discuss tax withholdings maximizing tax-advantaged accounts and charitable tax deductions.

When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden. One of the most popular tax-saving strategies for high-income earners involves charitable contributions. Health Savings Account Investing.

Use a Health Savings Account HSA Photo by Online Marketing on Unsplash. The law permits you to deduct the amount you deposit into a tax-certified retirement account from your tax return. Note that if youre aged 50 or above you can make an extra annual.

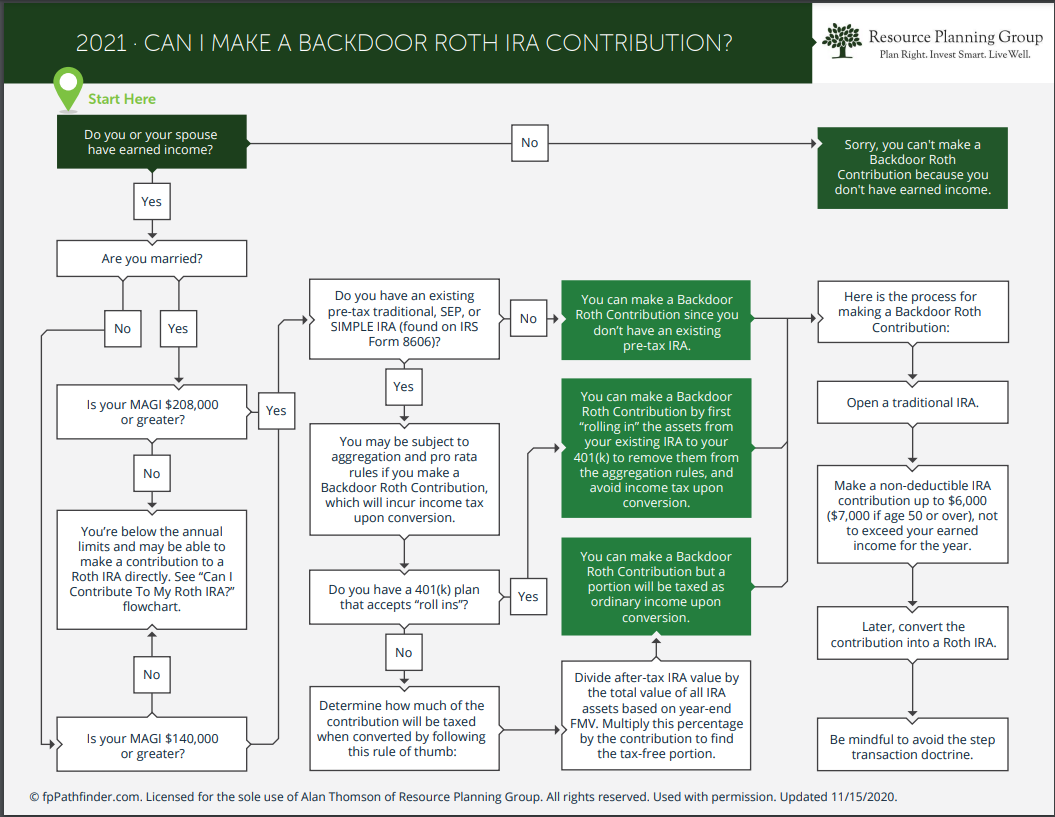

Donor-advised funds allow you to get a. If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA. Now may be an excellent time to purchase a home or opt for a cash-out refinance.

Grab your 2020 tax return and. The 2022 annual limit is 20500 an increase from the 19500 limit imposed for the 2020 and 2021 tax seasons. For example a single taxpayer earning up to 9950 will pay around 10 of their taxable income.

Lets make sure you have the know-how to implement these year-end tax strategies made especially for high-income earners. However if that single person earns more than 523600 that year they will pay taxes of 37. 5 Tax Strategies High Income Earners Should Be Leveraging.

Managing the timing of substantial gains to avoid being subject to the Medicare surtax or being pushed into the 20 percent capital gains bracket should be a part of effective tax strategy for high-income earners. Third you reduce your tax burden because the money goes straight to a charity so it does not appear as income on your tax return. The main reason is that youre able to recover the cost of income-producing property through the use of depreciation.

Under RS rules you can deduct charitable cash contributions of up to 60 of your adjusted gross income. Your Modified Adjusted Gross Income MAGI. 5 Reduce Taxable Income with a Side Business.

Beginning with the Tax Cut and Jobs Act TCJA of 2017 our Congress has been active at passing legislation that has had material changes to our tax code affecting both retirement and tax planning strategies. An Edward Jones Financial Advisor Can Partner Through Lifes Moments. Just note that when you take this and other itemized deductions you forgo the standard tax deduction which.

Visit The Official Edward Jones Site. There are a few ways to take advantage of charitable deductions including. Strategy 2 Defer Taxes on Realized Gains.

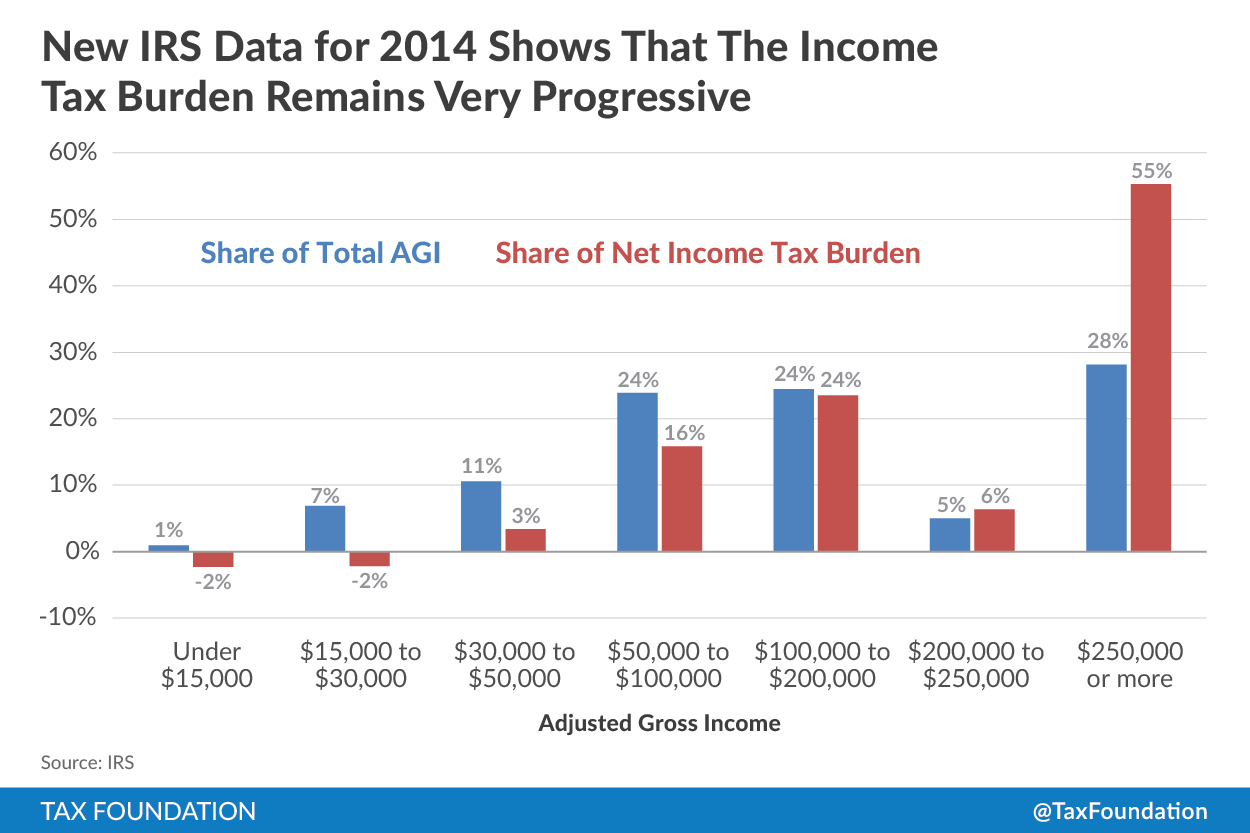

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners. According to the IRS high-income earners pay almost 70 of the total federal income tax they collect.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. It is well known that deducting your charitable contributions can reduce taxable income. 2 days agoCalifornias top income tax rate 133 on taxable incomes over 1 million is by far the nations highest and when added to the top federal rate of.

Well need a couple of things for this. Not everyone is eligible. The top 1 of taxpayers those with the highest earnings account for almost 25 of all income tax revenue while the top 50 of taxpayers those in the highest income tax bracket account for 90 of all income tax revenue.

July 24 2020 225242. The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. In this article well look at the most common types of tax strategies for high-income earners and how you can make the most use of them.

A CRT is a gift of cash or other property to an irrevocable trust. We recommend doing a trial tax return before year-end to assess your tax implications thus allowing for current year action to maximize tax opportunities.

Difference Between High Income Earners And Being Rich Amazing Inspirational Quotes Quotes To Live By Reminder Quotes

5 Outstanding Tax Strategies For High Income Earners

How Do Taxes Affect Income Inequality Tax Policy Center

The Hierarchy Of Tax Preferenced Savings Vehicles

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Tax Strategies For High Income Earners 2022 Youtube

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

5 Outstanding Tax Strategies For High Income Earners

Opportunity For High Income Earners The Backdoor Roth Conversion Resource Planning Group

Millionaires And High Income Earners Tax Foundation

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

Astute Savers Don T Just Use 529 Plans For College Savings

6 Strategies To Reduce Taxable Income For High Earners

9 Ways For High Earners To Reduce Taxable Income 2022

Budget 2020 Dividend Distribution Tax Scrapped But Shifts The Burden To The Recipients High Income Earners To Bear Th Dividend Higher Income Dividend Income

The 4 Tax Strategies For High Income Earners You Should Bookmark